UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) [X] Definitive Proxy Statement [ ] Definitive Additional Materials [ ] Soliciting Material Pursuant to§240.14a-12

|

| |

|

| |

|

| |

|

| |

|

|

MANNING & NAPIER FUND, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] | No fee required. | |||

| [ ] | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. | |||

1) | Title of each class of securities to which transaction applies: | |||

2) | Aggregate number of securities to which transaction applies: | |||

3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

4) | Proposed maximum aggregate value of transaction: | |||

5) | Total fee paid: | |||

[ ] | Fee paid previously with preliminary materials. | |||

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

1) | Amount Previously Paid: | |||

2) | Form, Schedule or Registration Statement No.: | |||

3) | Filing Party: | |||

4) | Date Filed: | |||

July 1, 2015

MANNING & NAPIER FUND, INC.

Core Bond Series

Disciplined Value Series

Equity Income Series

High Yield Bond Series

International Series

Shareholder ProxyPro-Blend® Conservative Term Series

YourPro-Blend® Moderate Term Series

Pro-Blend® Extended Term Series

Pro-Blend® Maximum Term Series

Real Estate Series

Strategic Income Moderate Series

Unconstrained Bond Series

April 4, 2018

Dear Shareholder,

You are receiving this letter and the accompanying Notice and Proxy Statement because of your investment in Class S Shares of one or more of the series of the Manning & Napier Fund, Inc. (the “Fund”) listed above (the “Series”).

We are seeking your approval for a proposal that, together with other changes, is expected to have either no effect on the expenses of the Series’ Class S shares, or, for the Class S shares of a number of Series, is expected to result in savings for shareholders, based on current asset levels.

A meeting of Class S shareholders of the Series will be held on May 25, 2018, at the offices of Manning & Napier at 290 Woodcliff Drive, Fairport, NY 14450 at 11:00 a.m. Eastern Time (the “Meeting”).

At the Meeting, Class S shareholders of each Series will be asked to approve the adoption of a Rule12b-1 Distribution and Shareholder Services Plan (the“12b-1 Plan”) for the Class S Shares of the Series. If the12b-1 Plan is approved by Class S shareholders of a Series, the current shareholder services fee paid by Class S Shares of the Series would be replaced with a distribution and/or shareholder services fee(“12b-1 fee”) payable at an annual rate of up to 0.25% of the average daily net assets of the Class S Shares of the Series. At the same time, certain other changes described in the accompanying Proxy Statement will be made to the fees and expenses of the Class S Shares of the Series such that, at current asset levels, the total operating expenses (before and after waivers) of the Class S Shares of each Series are expected to stay the same or decrease.

More information about the12b-1 Plan and the concurrent changes to the fees and expenses of the Class S Shares of the Series is contained in the accompanying Proxy Statement. Please review the Proxy Statement carefully and retain it for future reference.

The Board of Directors of the Fund (the “Board”) determined that there is a reasonable likelihood that the12b-1 Plan will benefit the Class S shareholders and that the12b-1 Plan is in the best interest of the Class S Shares of each Series. Accordingly,the Board unanimously approved the12b-1 Plan, and recommends that you vote “FOR” the12b-1 Plan.

Whether or not you plan to attend the Meeting,we need your vote.The12b-1 Plan must be approved by the Class S shareholders of a Series before it can be implemented for the class. In the event that insufficient votes are received from Class S shareholders of a Series, the Meeting may be adjourned with respect to that Series to permit further solicitation of proxies.

Voting is important!quick and easy. Everything you need is enclosed.Please vote by Internet, phone, or mail today.

Please readThank you for taking the time to consider this important proposal and respond today.for your continuing investment.

See inside for informationSincerely,

that affects your

Michele T. Mosca

President, Chairman and Director

Manning & Napier Fund, Inc.

investments.

QUESTIONS AND ANSWERS

The following is a summary of certain information contained elsewhere in this Proxy Statement. Shareholders should read the entire Proxy Statement carefully for more complete information.

Why did you send me this Proxy Statement?

You are receiving this Proxy Statement because you owned Class S Shares of one or more of the series of the Manning & Napier Fund, Inc. (the “Fund”) covered by the Proxy Statement (the “Series”) as of March 27, 2018 (the “Record Date”) and have the right to vote on the proposal described herein. This Proxy Statement contains information that shareholders should know before voting.

What am I being asked to vote on?

You are being asked to approve a Distribution and Shareholder Services Plan (the“12b-1 Plan”) for the Class S Shares of the Series.

How does the Board of Directors of the Fund (the “Board”) suggest that I vote?

The Board determined that there is a reasonable likelihood that the12b-1 Plan will benefit the Class S shareholders and that the12b-1 Plan is in the best interest of the Class S Shares of each Series. Accordingly, the Board unanimously approved the12b-1 Plan, and recommends that shareholders vote “FOR” the12b-1 Plan.

Is my vote important?

Yes. The12b-1 Plan must be approved by the Class S shareholders of a Series before it can be implemented for the class. We need your vote to ensure that a quorum is reached and the12b-1 Plan can be voted upon.

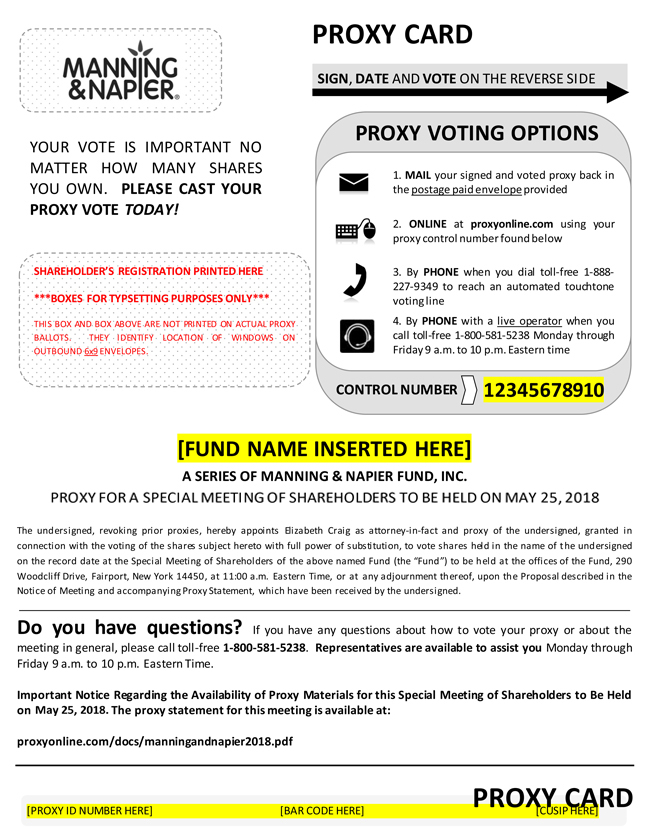

How do I vote?

You can vote in one of four ways:

We encourage you to vote as soon as possible so we can reach the needed quorum for the vote. Please refer to the enclosed proxy card for easy instructions for voting by Internet, phone, or mail.

Why would adoption of the12b-1 Plan benefit shareholders?

The12b-1 Plan provides a method of paying for distribution, shareholder, and/or administrative services provided by the Fund’s distributor, Manning & Napier Investor Services, Inc., or financial intermediaries. The12b-1 Plan would replace the Class S Shares’ current shareholder services plan, which cannot be used to pay for distribution services. Because the12b-1 Plan provides a method of paying for distribution services, it has the potential to increase the assets of the Series, and lead to lower expenses due to greater economies of scale and a wider range of investment opportunities. There can be no guarantee, however, that these potentials will be achieved.

What will be the effect of the12b-1 Plan on the Class S Shares’ expenses?

If the12b-1 Plan is approved by Class S shareholders of a Series, the current shareholder services fee paid by Class S Shares of the Series would be replaced with a distribution and/or shareholder services fee(“12b-1 fee”) payable at an annual rate of up to 0.25% of the average daily net assets of the Class S Shares of the Series. At the same time, certain other changes to the fees and expenses of the Class S Shares of the Series will be made such that, at current asset levels, the total operating expenses (before and after waivers) of the Class S Shares of each Series are expected to stay the same or decrease. More information about the concurrent changes to the fees and expenses of the Class S Shares of the Series is contained in the “Concurrent Changes Impacting Expenses” section of the Proxy Statement.

What will happen if a Series’ Class S shareholders do not approve the12b-1 Plan for their Series?

If the12b-1 Plan is not approved by the Class S shareholders of a Series, the Board will take such action as it determines to be in the best interest of the Class S Shares of the Series, and may consider other alternatives, including retaining the current shareholder services fee for the class. The approval of the12b-1 Plan for the Class S shares of one Series is not contingent on the approval of the12b-1 Plan for the Class S shares of any other Series.

Who will pay the costs of the proxy solicitation?

Manning & Napier Advisors, LLC, the investment advisor of the Series, will pay the cost of preparing, printing and mailing the enclosed proxy card(s) and Proxy Statement and all other costs incurred in connection with the solicitation of proxies.

Whom should I call if I have questions?

For additional voting information, please call the Fund’s proxy solicitor toll-free at1-800-581-5238. Representatives will be available Monday through Friday from 9:00 a.m. to 10:00 p.m., Eastern Time.

MANNING & NAPIER FUND, INC.

Core Bond Series

Disciplined Value Series

Equity Income Series

High Yield Bond Series

International Series

Pro-Blend® Conservative Term Series

Pro-Blend® Moderate Term Series

Pro-Blend® Extended Term Series

Pro-Blend® Maximum Term Series

Real Estate Series

Strategic Income Moderate Series

Unconstrained Bond Series

290 WOODCLIFF DRIVE

FAIRPORT, NEW YORK 14450

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON AUGUST 18, 2015May 25, 2018, 2018

Notice is hereby given that a meeting of Class S shareholders of the above referenced series (the “Meeting”“Series”) of Manning & Napier Fund, Inc. (the “Fund”) will be held at the offices of the Fund, 290 Woodcliff Drive, Fairport, New York 14450, on Tuesday, August 18, 2015,May 25, 2018, beginning at 9:11:00 a.m. (Eastern Time)Eastern Time (the “Meeting”).

At the Meeting, Class S shareholders of the Fundeach Series will be asked to elect six members toapprove the Boardadoption of Directorsa Rule12b-1 Distribution and Shareholder Services Plan(“12b-1 Plan”) for the Class S Shares of the Fund (the “Board”),their Series, and to transact such other business as may be properly brought before the Meeting or any adjournment(s) thereof.

The attached Proxy Statement provides additional information about the Meeting. Shareholders of record of the FundClass S Shares of the Series as of the close of business on June 10, 2015March 27, 2018 are entitled to vote at the Meeting and any adjournments(s)adjournment(s) thereof. Each shareClass S Share of the Funda Series is entitled to one vote, and a proportionate fractional vote for each fractional share.

Whether or not you plan to attend the Meeting in person, please vote your shares. To vote by mail please complete, date, and sign the enclosed proxy card(s)

and return it in the self-addressed, postage-paid envelope.If you return thea properly executed proxy card(s)card by mail and no instructions are marked on the proxy card(s),card, the proxy will vote your shares FORfor the electionadoption of each nominee and in the discretion of the person named as proxy in connection with any other matter that may properly come before the Meeting.12b-1 Plan.If you have returned a proxy card(s)card and are present at the Meeting, you may change the vote specified in the proxy at that time. However, attendance in person at the Meeting, by itself, will not revoke a previously tendered proxy. You may also vote by telephone or Internet, as follows:

To vote by telephone:

(1)Read the Proxy Statement and have your proxy card at hand. (2)Call the toll-free number that appears on your proxy card(s). (3) Follow the simple instructions. To vote by Internet (1) Read the Proxy Statement and have your proxy card at hand. (2) Go to the Internet address that appears on your proxy card(s). (3) Follow the simple instructions. |

| |

We encourage you to vote by telephone or Internet using the control number that appears on the enclosed proxy card(s). Voting by telephone or Internet will reduce the time and costs associated with this proxy solicitation. Whichever method of voting you choose, please read the enclosed Proxy Statement carefully before you vote.

The persons named as proxies will vote in their discretion on any other business thatas may be properly comebrought before the Meeting or any adjournmentsadjournment(s) thereof.

If the necessary quorum to transact business or the vote required to approve the electionadoption of the12b-1 Plan for the Class S Shares of any nomineeSeries is not obtained at the Meeting, the persons named as proxies may propose one or more adjournments of the Meeting with respect to such Series in accordance with applicable law to permit further solicitations of proxies.

Important Notice Regarding the Availability of Proxy Materials for the

the Shareholder Meeting To Be Held on August 18, 2015.May 25, 2018.

The proxy statement is available atproxyvote.comproxyonline.com/docs/manningandnapier2018.pdf.

For additional voting information, shareholders should call1-800-581-5238 Monday through Friday 9 a.m. to 10 p.m. Eastern Time.

PLEASE RESPOND – WE ASK THAT YOU VOTE PROMPTLY IN ORDER TO AVOID THE ADDITIONAL EXPENSE OF FURTHER SOLICIATION.SOLICITATION. YOUR VOTE IS IMPORTANT. WE ENCOURAGE YOU TO SUPPORT THE BOARD OF DIRECTORS’ RECOMMENDATIONSRECOMMENDATION AND VOTE FOR“FOR” THE ELECTIONADOPTION OF ALL NOMINEES.THE12B-1 PLAN.

By order of the Board of Directors,

Jodi L. Hedberg

Secretary

July 1, 2015

| By order of the Board of Directors, |

| Elizabeth Craig |

| Secretary |

| Manning & Napier Fund, Inc. |

| April 4, 2018 |

MANNING & NAPIER FUND, INC.

| Core Bond Series | ||

Equity Income Series

High Yield Bond Series

International Series

Pro-Blend® Conservative Term Series

Pro-Blend® Moderate Term Series

Pro-Blend® Extended Term Series

Pro-Blend® Maximum Term Series

Real Estate Series

Strategic Income Moderate Series

Unconstrained Bond Series

SPECIAL MEETING OF SHAREHOLDERS

To be held on Tuesday, August 18, 2015May 25, 2018

PROXY STATEMENT

GENERAL

This document is a proxy statement (the “Proxy Statement”). This Proxy Statement and enclosed proxy card(s) are being furnished to Class S shareholders of each of the Core Bond Series, Disciplined Value Series, Diversified Tax Exempt Series, Dynamic Opportunities Series, Emerging Markets Series, Equity Series, Equity Income Series, Focused Opportunities Series, Global Fixed Income Series, High Yield Bond Series, International Series, New York Tax Exempt Series, Ohio Tax Exempt Series, Overseas Series, Pro-Blend® Conservative Term Series, Pro-Blend® Extended Term Series, Pro-Blend® Maximum Term Series, Pro-Blend® Moderate Term Series, Quality Equity Series, Real Estate Series, Strategic Income Conservative Series, Strategic Income Moderate Series, Target 2010 Series, Target 2015 Series, Target 2020 Series, Target 2025 Series, Target 2030 Series, Target 2035 Series, Target 2040 Series, Target 2045 Series, Target 2050 Series, Target 2055 Series, Target Income Series, Tax Managed Series, Unconstrained Bond Series and World Opportunities Series (each, aabove referenced series (the “Series”) of the Manning & Napier Fund, Inc. (the “Fund”).

The Board of Directors of the Fund (the “Board”) is soliciting proxies from Class S shareholders on behalf of each Series, for use at the Meeting of Shareholders, to be held at 290 Woodcliff Drive, Fairport, New York 14450, at 9:11:00 a.m. Eastern Time, on Tuesday, August 18, 2015,May 25, 2018, and at any and all adjournments thereof (the “Meeting”).

The Board has fixed the close of business on June 10, 2015,March 27, 2018 as the record date for determination of shareholders entitled to notice of and to vote at the Meeting (the “Record Date”). You are entitled to vote at the Meeting and any adjournment(s) with respect to a Series if you owned sharesClass S Shares of that Series at the close of business on the Record Date.

This Proxy Statement, the Notice of Meeting and the proxy card(s) are first being mailed to shareholders on or about July 1, 2015.April 5, 2018.

At the Meeting, Class S shareholders of the Fundeach Series will be asked to elect six members toapprove the Boardadoption of a Rule12b-1 Distribution and Shareholder Services Plan(“12b-1 Plan”) for the Class S Shares of their Series, and to transact such other business as may be properly brought before the Meeting or any adjournment(s) thereof. If the12b-1 Plan is adopted by Class S shareholders of a Series, the current shareholder services fee paid by Class S Shares of the Series would be replaced with a new asset-based fee for distribution and/or shareholder services. The fee paid by a fund pursuant to this type of plan is commonly referred to as a“12b-1 fee.”

The new12b-1 fee under the12b-1 Plan would be payable at an annual rate of up to 0.25% of the average daily net assets of the Class S Shares of a Series, but would be fully offset by the following concurrent changes to the fees and expenses of the Class S Shares of the Series:

| (i) | The elimination of the current shareholder services fee paid by the Class S Shares of the Series under the Class S Shareholder Services Plan (as defined below); and |

| (ii) | For the Equity Income Series andPro-Blend® Conservative Term Series, a reduction in the contractual investment management fees paid by the Series, and a reduction in the expense limitations for the Class S Shares of the Series, to offset the difference between the current shareholder services fee for the Class S Shares of the Series and the amount that would be payable by the Class S Shares of the Series pursuant to the12b-1 Plan. |

At a Board meeting held on May 28, 2015,August 24, 2017 (the “Board Meeting”), the Board approved the elimination of the shareholder services fee for the Class S Shares of the Series. The Board also approved new agreements with Manning & Napier Advisors, LLC, the investment advisor of the Series (the “Advisor”), with respect to the Equity Income Series andPro-Blend® Conservative Term Series that implement the reductions in the contractual investment management fees paid by the Series and the reductions in the expense limitations for the Class S Shares of the Series, subject to shareholder approval of the12b-1 Plan for the Class S Shares of the Series.

1

The Board and the Advisor have agreed that the Fund will not implement the12b-1 Plan for the Class S Shares of a Series without concurrently eliminating the shareholder services fee for the Class S Shares of the Series, and, with respect to the Equity Income Series andPro-Blend® Conservative Term Series, reducing the contractual investment management fees paid by the Series and the expense limitations for the Class S Shares of the Series, as described in “Concurrent Changes Impacting Expenses” below.

These changes will also reduce the fees incurred indirectly by the Strategic Income Moderate Series as a result of its investments in other Series of the Fund (commonly referred to in mutual fund fee tables as “acquired fund fees and expenses” or “AFFE”).

Accordingly, at current asset levels, the total operating expenses (before and after waivers) for the Class S Shares of the Strategic Income Moderate Series are expected to stay the same or decrease as a result of the implementation of the12b-1 Plan and the concurrent contractual changes to the fees and expenses of the Class S Shares of the Series.

For more information regarding the expenses of the Class S Shares of the Series, please see“12b-1 Plan Impact on Expenses”, “Concurrent Changes Impacting Expenses,” and “Overall Impact on Expenses” below.

At the Board Meeting, the Board determined that there is a reasonable likelihood that the12b-1 Plan will benefit the Class S shareholders and that the12b-1 Plan is in the best interest of the Class S Shares of each Series. Accordingly, the Board unanimously approved the12b-1 Plan, and recommended that you vote FOR“FOR” the election12b-1 Plan.

If the12b-1 Plan is not approved by the Class S shareholders of all nominees.a Series, the Board will take such action as it determines to be in the best interest of the Class S Shares of the Series, and may consider other alternatives, including retaining the current shareholder services fee for the class.

1

Your vote is important and we recommend that you read this Proxy Statement in its entirety to help you decide how to vote.

This Proxy Statement should be kept for future reference. The most recent annual and semi-annual reports, as applicable, for the Series have been sent to shareholders. If you would like to receive an additional copy of an annual or semi-annual report, as applicable, free of charge, visit the Fund’s web site at www.manning-napier.com/documents or call the Fund at800-466-3863.

PROPOSAL: APPROVAL OF THE ADOPTION OF A

RULE12b-1 DISTRIBUTION AND SHAREHOLDER SERVICES PLAN

Background

At the Board Meeting, the Board considered and unanimously approved the adoption of the12b-1 Plan pursuant to Rule12b-1 under the Investment Company Act of 1940, as amended (the “1940 Act”), for the Class S Shares of the Series, subject to shareholder approval. The Board’s approval of the12b-1 Plan included an affirmative vote by a majority of those Directors who are not “interested persons” of the Fund, as defined in the 1940 Act, and who have no direct or indirect financial interest in the operation of the proposed12b-1 Plan or any agreements related to it (the “Independent Directors”), cast in person at the Board Meeting (which was called for the purpose of voting on the12b-1 Plan).

At the Meeting, Class S shareholders of each Series will be asked to approve the adoption of the12b-1 Plan for the Class S Shares of their Series. If the12b-1 Plan is approved by Class S shareholders of a Series, the current shareholder services fee paid by Class S Shares of the Series would be replaced with a12b-1 fee payable at an annual rate of up to 0.25% of the average daily net assets of the Class S Shares of the Series. At the same time, certain other changes to the fees and expenses of the Class S Shares of the Series will be made such that, at current asset levels, the total operating expenses (before and after waivers) of the Class S Shares of each Series are expected to stay the same or decrease. Please see “Concurrent Changes Impacting Expenses” for more information about the concurrent changes to the fees and expenses of the Class S Shares of the Series.

The12b-1 Plan has the potential to increase the assets of the Series, and lead to lower expenses due to greater economies of scale, and a wider range of investment opportunities. There can be no guarantee, however, that these potentials will be achieved.

2

If approved, the12b-1 Plan will become effective with respect to a Series later this year.

THE BOARD UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE ADOPTION OF THE12B-1 PLAN.

Description of the12b-1 Plan

The discussion of the12b-1 Plan below is a summary of the12b-1 Plan, a form of which is attached to this Proxy Statement as Appendix A. Set forth below is a summary of all material terms of the12b-1 Plan. Although the summary below is qualified in its entirety by reference to the form of12b-1 Plan, shareholders should still read the summary below carefully.

Payments

Pursuant to the12b-1 Plan, Class S Shares of the Series would be subject to an annual distribution and/or shareholder services fee of up to 0.25% of the class’s average daily net assets. The12b-1 Plan provides a method of paying for distribution, shareholder and/or administrative services provided by Manning & Napier Investor Services, Inc. (the “Distributor”), or financial intermediaries and other organizations, including affiliates of the Distributor, that enter into agreements with the Distributor (“Service Organizations”).

Generally, fees paid under the12b-1 Plan will not be retained by the Distributor, but will instead bere-allowed to Service Organizations. The12b-1 Plan and class structure of the Fund permit the Fund to allocate an amount of fees to a Service Organization based on the level of distribution and/or shareholder services it agrees to provide. The12b-1 Plan is of the type known as a “compensation” plan. This means that payments under the12b-1 Plan are made as described above regardless of the Distributor’s actual cost of providing the services. If the cost of providing the services under the12b-1 Plan is less than the payments received, the unexpended portion of the fees may be retained as profit by the Distributor.

Services for Which Payments May Be Used

With respect to distribution services, the Distributor may use the fee payable pursuant to the12b-1 Plan on any activities or expenses primarily intended to result in the sale of Class S Shares, including, but not limited to, (i) as compensation for the Distributor’s services in connection with distribution assistance; or (ii) as a source of payments to Service Organizations, such as banks, savings and loan associations, insurance companies and investment counselors, broker-dealers, and mutual fund supermarkets, as compensation for services or reimbursement of expenses incurred in connection with distribution assistance. Expenses and services for which the Distributor or Service Organization may be compensated include, without limitation, expenses (including overhead and telephone expenses) of, and compensation to, employees of the Distributor or Service Organization who engage in or support the distribution of Class S Shares, and preparing, printing and distributing sales literature and advertising materials and the printing of prospectuses, statements of additional information, and reports for other than existing shareholders.

With respect to shareholder services, the Distributor may provide, or enter into agreements with Service Organizations to provide, certain shareholder, administrative andnon-distribution services for Class S shareholders, including, but not limited to: (i) maintaining shareholder accounts; (ii) responding to shareholder inquiries relating to the services performed by the Distributor and/or Service Organization; (iii) responding to inquiries from shareholders concerning their investment in the Series; (iv) assisting shareholders in changing dividend options, account designations and addresses; (v) providing information periodically to shareholders showing their position in the Series; (vi) forwarding shareholder communications from the Fund such as proxies, shareholder reports, annual reports, and dividend distribution and tax notices to shareholders; (vii) processing purchase, exchange and redemption requests from shareholders and placing orders with the Fund or its service providers; (viii) arranging for bank wires; (ix) providingsub-accounting services; (x) processing dividend payments from the Fund on behalf of shareholders; (xi) preparing tax reports; and (xii) providing such other similarnon-distribution services as the Fund or the Distributor may reasonably request to the extent that the Service Organization is permitted to do so under applicable laws or regulations.

Duration, Termination and Board Reporting

The12b-1 Plan would continue in effect for the Class S Shares of each Series for so long as its continuance is specifically approved at least annually by votes of the majority of both (i) the Directors of the Fund and (ii) the Independent Directors, cast in person at a meeting called for the purpose of voting on the12b-1 Plan. The12b-1 Plan may be terminated with

respect to the Class S Shares of a Series at any time without penalty by a vote of a majority of the outstanding voting securities of such Class S Shares or a majority of the Independent Directors.

3

Amendments and Board Reporting

The12b-1 Plan may not be amended to increase materially the amount of distribution expenses permitted to be paid under the12b-1 Plan for the Class S Shares of a Series without the approval of shareholders holding a majority of the outstanding voting securities of such class. All material amendments to the12b-1 Plan must be approved by votes of the majority of both (i) the Directors of the Fund and (ii) the Independent Directors. The12b-1 Plan requires that written reports of amounts spent under the12b-1 Plan and the purposes of such expenditures be furnished to and reviewed by the Board on a quarterly basis.

12b-1 Plan Impact on Expenses

If the12b-1 Plan is adopted by Class S shareholders of a Series, the Class S Shares would pay a new asset-based fee for distribution and/or shareholder services at an annual rate of up to 0.25% of the average daily net assets of the Class S Shares. The new12b-1 fee under the12b-1 Plan would, however, be fully offset by the concurrent contractual changes to the fees and expenses of the Class S Shares of the Series discussed in “Elimination of Current Shareholder Services Fee” and “Additional Reductions in Investment Management Fees and Expense Limitations for the Equity Income Series andPro-Blend® Conservative Term Series” in the following section.

Concurrent Changes Impacting Expenses

The Board also approved the following concurrent changes to the fees and expenses of the Class S Shares of the Series, as indicated in the section headings.

SHAREHOLDERS ARE NOT BEING ASKED TO APPROVE THE CHANGES DISCUSSED BELOW.

| I. | Elimination of Current Shareholder Services Fee (All Series) |

The Board has approved the elimination of the shareholder services fee currently payable by the Class S Shares of a Series, subject to shareholder approval of the12b-1 Plan for the Class S Shares of the Series. The shareholder services fee, which is payable pursuant to a shareholder services plan previously adopted by the Board (“Shareholder Services Plan”), may be used by the Class S Shares of the Series as payment to the Advisor, and to financial intermediaries for the provision of shareholder and/or administrative services to the Class S shareholders of the Series. Unlike the proposed12b-1 fee under the12b-1 Plan, the current Class S shareholder services fee cannot be used to compensate financial intermediaries for distribution services because Rule12b-1 prohibits mutual funds from engaging, directly or indirectly, in the financing of any activity which is primarily intended to result in the sale of fund shares (i.e., distribution) except pursuant to a written plan approved by shareholders (such as the12b-1 Plan).

The current shareholder services fee for each Series (other than the Equity Income Series andPro-Blend® Conservative Term Series, which are discussed in Section IV), is 0.25% of the average daily net assets of the Series’ Class S Shares. Therefore, the total operating expenses (before and after waivers) for the Class S Shares of each Series, except for the Equity Income Series andPro-Blend® Conservative Term Series, will stay the same as a result of the implementation of the12b-1 Plan and the concurrent elimination of the shareholder services fee.

The Board and the Advisor have agreed that the Fund will not implement the12b-1 Plan for the Class S Shares of a Series without concurrently eliminating the shareholder services fee for the Class S Shares of the Series.

| II. | Non-Distribution Services Arrangement (All Series) |

The Board has approved theNon-Distribution Services Arrangement for the Class S Shares of the Series, which will be implemented concurrently with the12b-1 Plan for the Class S Shares of the Series (if approved).Implementation of theNon-Distribution Services Arrangement, however, does not require shareholder approval, and is not contingent on shareholder approval of the12b-1 Plan.

Pursuant to theNon-Distribution Services Arrangement, sometimes referred to as a“sub-transfer agency fee arrangement,” the Class S Shares of each Series may pay Service Organizations fornon-distribution services, such assub-transfer agency, administrative,sub-accounting and shareholder services, in an amount not to exceed 0.15% of the average daily net assets of the Class S Shares of the Series. Any payments made pursuant to theNon-Distribution Services Arrangement may be in addition to, rather than in lieu of, any fee payable under the12b-1 Plan.

The Fund will consider the nature of the services provided by a Service Organization (i.e., distribution ornon-distribution services) in determining whether payments to the Service Organization will be made pursuant to the12b-1 Plan or theNon-Distribution Services Arrangement. Payments to Service Organizations that provide only distribution services will be made pursuant to the12b-1 Plan. Payments to Service Organizations that provide onlynon-distribution services, or both

distribution andnon-distribution services, will generally be first made pursuant to the12b-1 Plan, and then made pursuant to theNon-Distribution Services Arrangement to the extent that the total amount payable to a Service Organization exceeds the 0.25% maximum amount payable pursuant to the12b-1 Plan and, in the case of a Service Organization that provides both distribution andnon-distribution services, the Fund determines that the payments made pursuant to theNon-Distribution Services Arrangement are fornon-distribution services.

4

As discussed in Sections III – V, certain other changes to the fees and expenses of the Class S Shares of the Series will be made such that, at current asset levels, the total operating expenses (before and after waivers) of the Class S Shares of each Series are expected to stay the same or decrease as a result of the implementation of theNon-Distribution Services Arrangement and the concurrent changes.

| III. | Reductions in Investment Management Fees in Connection with theNon-Distribution Services Arrangement (All Series other than the Strategic Income Moderate Series) |

In connection with the approval of theNon-Distribution Services Arrangement, the Advisor proposed, and the Board approved, amendments to the Fund’s investment advisory agreement that result in 0.15% reductions in the contractual investment management fees paid by each Series (other than the Strategic Income Moderate Series, which is discussed in Section V). As a result, the total operating expenses (before and after waivers) for the Class S Shares of each Series (other than the Strategic Income Moderate Series) will not increase as a result of the implementation of theNon-Distribution Services Arrangement and the concurrent reduction in the contractual investment management fees paid by the Series. At current asset levels, the total operating expenses (before and after waivers) of the Class S Shares of many of the Series are instead expected to decrease as a result of these changes, because the contractual investment management fee reductions are expected to exceed the amount of payments made by the Class S Shares of the Series pursuant to theNon-Distribution Services Arrangement.

The investment management fee reductions are reflected in the Amended and Restated Schedule A to the Investment Advisory Agreement attached to this Proxy Statement as Appendix B. The Board and the Advisor have agreed that the Fund will not implement theNon-Distribution Services Arrangement for the Class S Shares of a Series (other than the Strategic Income Moderate Series) without concurrently implementing the contractual investment management fee reductions.

| IV. | Additional Reductions in Investment Management Fees and Expense Limitations (Equity Income Series andPro-Blend® Conservative Term Series) |

As discussed above, if the12b-1 Plan is approved by the Class S shareholders of the Equity Income Series andPro-Blend® Conservative Term Series, the current shareholder services fee of 0.20% paid by the Class S Shares of the Series will be eliminated and replaced by a 0.25%12b-1 fee. In addition, the Advisor proposed, and the Board approved, amendments to the Fund’s investment advisory agreement that, subject to shareholder approval of the12b-1 Plan for the Class S Shares of the Series, result in 0.05% reductions in the contractual investment management fees for the Equity Income Series andPro-Blend® Conservative Term Series to offset the difference between the current shareholder services fee of 0.20% paid by the Class S Shares of the Series and the proposed 0.25%12b-1 fee, in addition to 0.15% reductions in the contractual investment management fees for the Series to offset the implementation of theNon-Distribution Services Arrangement for the Class S Shares of the Series, for total investment management fee reductions of 0.20% for each Series. Accordingly, the total operating expenses before waivers of the Class S Shares of the Series will not increase as a result of the implementation of the12b-1 Plan and theNon-Distribution Services Arrangement and the concurrent elimination of the shareholder services fee and reductions in the contractual investment management fees paid by the Series.

Additionally, because the investment management fees, unlike the shareholder services fees and12b-1 fees, are included in the Series’ expense limitations, the Advisor proposed, and the Board approved, amendments to the expense limitation agreements for the Class S Shares of the Equity Income Series andPro-Blend® Conservative Term Series that result in 0.05% reductions in the expense limitations for the Class S Shares of the Series, subject to shareholder approval of the12b-1 Plan for the Class S Shares of the Series. Accordingly, the total operating expenses after waivers of the Class S Shares of the Series will stay the same as a result of the implementation of the12b-1 Plan and the concurrent elimination of the shareholder services fee and reductions in the expense limitations for the Class S Shares of the Series.

The investment management fee reductions are reflected in the Amended and Restated Schedule A to the Investment Advisory Agreement attached to this Proxy Statement as Appendix B. The expense limitation reductions are reflected in the Amended and Restated Expense Limitation Agreement for the 10/31 Series (as defined below) attached to this Proxy Statement as Appendix C, and the Amended and Restated Expense Limitation Agreement for the 12/31 Series (as defined below) attached to this Proxy Statement as Appendix D. The Board and the Advisor have agreed that the Fund will not implement the12b-1 Plan or theNon-Distribution Services Arrangement for the Class S Shares of the Equity Income Series andPro-Blend® Conservative Term Series without concurrently implementing the contractual investment management fee and expense limitation reductions.

5

| V. | Changes to Expense Limitations and Acquired Fund Fees and Expenses (Strategic Income Moderate Series) |

As discussed above, the fee payable pursuant to the12b-1 Plan for the Class S Shares of the Strategic Income Moderate Series (if approved) will be offset by the elimination of the shareholder services fee for the Class S Shares of the Series. However, the fee payable pursuant to theNon-Distribution Services Arrangement for the Class S Shares of the Strategic Income Moderate Series will not be offset by a reduction in the contractual investment management fees paid by the Strategic Income Moderate Series because the Strategic Income Moderate Series invests in other Series of the Fund, and do not pay an investment management fee. Accordingly, in connection with the approval of theNon-Distribution Services Arrangement for the Class S Shares of the Strategic Income Moderate Series, the Advisor proposed, and the Board approved, amendments to the expense limitation agreement for the Class S Shares of the Series that result in 0.15% increases in the expense limitations for the Class S Shares of the Series.

Despite the implementation of theNon-Distribution Services Arrangement and the concurrent increases in the expense limitations for the Class S Shares of the Strategic Income Moderate Series, at current asset levels, the total operating expenses (before and after waivers) of the Class S Shares of the Series are expected to decrease. The total operating expenses (before and after waivers) of the Class S Shares of the Series are expected to decrease because the reductions in the AFFE incurred by the Series are expected to exceed the amount of payments made by the Class S Shares of the Series pursuant to theNon-Distribution Services Arrangement and the increases in the expense limitations for the Class S Shares of the Series (which exclude AFFE). The amount of AFFE incurred by the Strategic Income Moderate Series will decrease because the Strategic Income Moderate Series invests in other Series of the Fund that will have their contractual investment management fees reduced in connection with theNon-Distribution Services Arrangement, and the Strategic Income Moderate Series invests in classes of such Series that are not subject to theNon-Distribution Services Arrangement.

The expense limitation increases are reflected in the Amended and Restated Expense Limitation Agreement for the 12/31 Series attached to this Proxy Statement as Appendix D.

Overall Impact on Expenses

The tables below show how the total operating expenses (before and after waivers) of the Class S Shares of each Series for the most recent fiscal year would have changed if the12b-1 Plan and theNon-Distribution Services Arrangement had been in place throughout the period. The tables below take into account the following additional items that were approved by the Board at the Board Meeting, and must be implemented concurrently with the implementation of the12b-1 Plan and theNon-Distribution Services Arrangement for the Class S Shares of a Series: (i) the elimination of the Class S shareholder services fee; (ii) the decreases in the contractual investment management fees for the Series, as applicable, and (iii) the changes in the expense limitations for the Class S Shares of the Series, as applicable.

The expenses for the Class S Shares of a Series will not necessarily always be lower than the current expenses for such Class S Shares because fees and expenses can increase in the future for a variety of reasons, such as decreases in net assets, increases in the amount of payments made pursuant to theNon-Distribution Services Arrangement, and changes in shareholder composition and the number of shareholder accounts, and not all fees and expenses are covered by the expense limitations (as noted above). In addition, the expense limitations may be terminated. However, the contractual investment management fees and the12b-1 fees may not be increased without shareholder approval, and the expense limitations may not be terminated prior to February 28, 2020 with respect to the Series that have a fiscal year end of October 31 (the “10/31 Series”), and April 30, 2020 with respect to the Series that have a fiscal year end of December 31 (the “12/31 Series”), without the approval of the Board. The 10/31 Series are thePro-Blend® Conservative Term Series,Pro-Blend® Moderate Term Series,Pro-Blend® Extended Term Series,Pro-Blend® Maximum Term Series, and Disciplined Value Series. The 12/31 Series are the Core Bond Series, Equity Income Series, High Yield Bond Series, International Series, Real Estate Series, Strategic Income Moderate Series, and Unconstrained Bond Series.

6

Core Bond Series – Class S

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

Current (unaudited) | Pro-Forma (unaudited) | |||

| Management Fees | 0.40% | 0.25% | ||

| Distribution and Service(12b-1) Fees | None | 0.25% | ||

| Other Expenses | 0.37% | 0.26% | ||

Shareholder Services Fees | 0.25% | None | ||

Remainder of Other Expenses | 0.12% | 0.26%1 | ||

Total Annual Fund Operating Expenses | 0.77% | 0.76% | ||

Less Fee Waivers and/or Expense Reimbursements | (0.07)%2 | (0.06)%3 | ||

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | 0.70% | 0.70% | ||

| 1Includes payments pursuant to theNon-Distribution Services Arrangement of 0.14% of the average daily net assets of the Class S Shares. Payments pursuant to theNon-Distribution Services Arrangement may be up to 0.15% of the average daily net assets of the Class S Shares. | ||||

| 2The Advisor has contractually agreed to limit its fees and reimburse expenses to the extent necessary so that the total direct annual fund operating expenses of Class S Shares, exclusive of Shareholder Services Fees, do not exceed 0.45% of the average daily net assets of the Class S Shares. This contractual waiver will continue until at least April 30, 2019 and may not be amended or terminated by the Advisor prior to such date without the approval of the Series’ Board of Directors. The Advisor’s agreement to limit the Series’ operating expenses is limited to direct operating expenses, and, therefore, does not apply to the indirect expenses incurred by the Series through its investments in other investment companies. | ||||

| 3The Advisor has contractually agreed to limit its fees and reimburse expenses to the extent necessary so that the total direct annual fund operating expenses of Class S Shares, exclusive of Distribution and Service(12b-1) Fees, do not exceed 0.45% of the average daily net assets of the Class S Shares. This contractual waiver will continue until at least April 30, 2020 and may not be amended or terminated by the Advisor prior to such date without the approval of the Series’ Board of Directors. The Advisor’s agreement to limit the Series’ operating expenses is limited to direct operating expenses, and, therefore, does not apply to the indirect expenses incurred by the Series through its investments in other investment companies. | ||||

Example

The Example below is intended to help you compare the cost of investing in the Series with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Series for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Series’ operating expenses remain the same (taking into account the Advisor’s contractual expense limitation for the first year only). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||

Current | $72 | $239 | $421 | $948 | ||||

Pro Forma | $72 | $237 | $416 | $937 |

Disciplined Value Series - Class S

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| Current | Pro-Forma (unaudited) | |||

Management Fees | 0.45% | 0.30% | ||

| Distribution and Service(12b-1) Fees | None | 0.25% | ||

Other Expenses | 0.37% | 0.21% | ||

Shareholder Services Fee | 0.25% | None | ||

Remainder of Other Expenses | 0.12% | 0.21%1 | ||

| Total Annual Fund Operating Expenses | 0.82% | 0.76% | ||

| 1Includes payments pursuant to theNon-Distribution Services Arrangement of 0.09% of the average daily net assets of the Class S Shares. Payments pursuant to theNon-Distribution Services Arrangement may be up to 0.15% of the average daily net assets of the Class S Shares. | ||||

7

Example

The Example below is intended to help you compare the cost of investing in the Series with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Series for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Series’ operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||

Current | $84 | $262 | $455 | $1,014 | ||||

Pro Forma | $78 | $243 | $422 | $942 |

Equity Income Series – Class S

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

Current (unaudited) | Pro-Forma (unaudited) | |||

| Management Fees | 0.65% | 0.45% | ||

| Distribution and Service(12b-1) Fees | None | 0.25% | ||

| Other Expenses | 0.39% | 0.31% | ||

Shareholder Services Fees | 0.20% | None | ||

Remainder of Other Expenses | 0.19% | 0.31%1 | ||

Acquired Fund Fees and Expenses (AFFE) | 0.14% | 0.14% | ||

Total Annual Fund Operating Expenses | 1.18% | 1.15% | ||

Less Fee Waivers and/or Expense Reimbursements | (0.09)%2 | (0.06)%3 | ||

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | 1.09% | 1.09% | ||

| 1Includes payments pursuant to theNon-Distribution Services Arrangement of 0.12% of the average daily net assets of the Class S Shares. Payments pursuant to theNon-Distribution Services Arrangement may be up to 0.15% of the average daily net assets of the Class S Shares. | ||||

| 2The Advisor has contractually agreed to limit its fees and reimburse expenses to the extent necessary so that the total direct annual fund operating expenses of Class S Shares, exclusive of Shareholder Services Fees, do not exceed 0.75% of the average daily net assets of the Class S Shares. This contractual waiver will continue until at least April 30, 2019 and may not be amended or terminated by the Advisor prior to such date without the approval of the Series’ Board of Directors. The Advisor’s agreement to limit the Series’ operating expenses is limited to direct operating expenses, and, therefore, does not apply to the indirect expenses incurred by the Series through its investments in other investment companies. | ||||

| 3The Advisor has contractually agreed to limit its fees and reimburse expenses to the extent necessary so that the total direct annual fund operating expenses of Class S Shares, exclusive of Distribution and Service(12b-1) Fees, do not exceed 0.70% of the average daily net assets of the Class S Shares. This contractual waiver will continue until at least April 30, 2020 and may not be amended or terminated by the Advisor prior to such date without the approval of the Series’ Board of Directors. The Advisor’s agreement to limit the Series’ operating expenses is limited to direct operating expenses, and, therefore, does not apply to the indirect expenses incurred by the Series through its investments in other investment companies. | ||||

8

Example

The Example below is intended to help you compare the cost of investing in the Series with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Series for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Series’ operating expenses remain the same (taking into account the Advisor’s contractual expense limitations for the first year only). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||

Current | $111 | $366 | $640 | $1,424 | ||||

Pro Forma | $111 | $359 | $627 | $1,392 |

High Yield Bond Series – Class S

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

Current (unaudited) | Pro-Forma (unaudited) | |||

| Management Fees | 0.55% | 0.40% | ||

| Distribution and Service(12b-1) Fees | None | 0.25% | ||

| Other Expenses | 0.42% | 0.32% | ||

Shareholder Services Fees | 0.25% | None | ||

Remainder of Other Expenses | 0.17% | 0.32%1 | ||

Acquired Fund Fees and Expenses (AFFE) | 0.01% | 0.01% | ||

Total Annual Fund Operating Expenses | 0.98% | 0.98% | ||

Less Fee Waivers and/or Expense Reimbursements | (0.07)%2 | (0.07)%3 | ||

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | 0.91% | 0.91% | ||

| 1Includes payments pursuant to theNon-Distribution Services Arrangement of 0.15% of the average daily net assets of the Class S Shares. Payments pursuant to theNon-Distribution Services Arrangement may be up to 0.15% of the average daily net assets of the Class S Shares. | ||||

| 2The Advisor has contractually agreed to limit its fees and reimburse expenses to the extent necessary so that the total direct annual fund operating expenses of Class S Shares, exclusive of Shareholder Services Fees, do not exceed 0.65% of the average daily net assets of the Class S Shares. This contractual waiver will continue until at least April 30, 2019 and may not be amended or terminated by the Advisor prior to such date without the approval of the Series’ Board of Directors. The Advisor’s agreement to limit the Series’ operating expenses is limited to direct operating expenses, and, therefore, does not apply to the indirect expenses incurred by the Series through its investments in other investment companies. | ||||

| 3The Advisor has contractually agreed to limit its fees and reimburse expenses to the extent necessary so that the total direct annual fund operating expenses of Class S Shares, exclusive of Distribution and Service(12b-1) Fees, do not exceed 0.65% of the average daily net assets of the Class S Shares. This contractual waiver will continue until at least April 30, 2020 and may not be amended or terminated by the Advisor prior to such date without the approval of the Series’ Board of Directors. The Advisor’s agreement to limit the Series’ operating expenses is limited to direct operating expenses, and, therefore, does not apply to the indirect expenses incurred by the Series through its investments in other investment companies. | ||||

Example

The Example below is intended to help you compare the cost of investing in the Series with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Series for the time periods indicated and then redeem

9

all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Series’ operating expenses remain the same (taking into account the Advisor’s contractual expense limitation for the first year only). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||

Current | $93 | $305 | $535 | $1,195 | ||||

Pro Forma | $93 | $305 | $535 | $1,195 |

10

International Series – Class S

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

Current (unaudited) | Pro-Forma (unaudited) | |||

Management Fees | 0.75% | 0.60% | ||

Distribution and Service(12b-1) Fees | None | 0.25% | ||

Other Expenses | 0.39% | 0.29% | ||

Shareholder Services Fees | 0.25% | None | ||

Remainder of Other Expenses | 0.14% | 0.29%1 | ||

Acquired Fund Fees and Expenses (AFFE) | 0.01% | 0.01% | ||

Total Annual Fund Operating Expenses | 1.15% | 1.15% | ||

Less Fee Waivers and/or Expense Reimbursements | (0.04)%2 | (0.04)%3 | ||

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | 1.11% | 1.11% | ||

| 1Includes payments pursuant to theNon-Distribution Services Arrangement of 0.15% of the average daily net assets of the Class S Shares. Payments pursuant to theNon-Distribution Services Arrangement may be up to 0.15% of the average daily net assets of the Class S Shares. | ||||

| 2 The Advisor has contractually agreed to limit its fees and reimburse expenses to the extent necessary so that the total direct annual fund operating expenses of Class S Shares, exclusive of Shareholder Services Fees, do not exceed 0.85% of the average daily net assets of the Class S Shares. This contractual waiver will continue until at least April 30, 2019 and may not be amended or terminated by the Advisor prior to such date without the approval of the Series’ Board of Directors. The Advisor’s agreement to limit the Series’ operating expenses is limited to direct operating expenses, and, therefore, does not apply to the indirect expenses incurred by the Series through its investments in other investment companies. | ||||

| 3 The Advisor has contractually agreed to limit its fees and reimburse expenses to the extent necessary so that the total direct annual fund operating expenses of Class S Shares, exclusive of Distribution and Service(12b-1) Fees, do not exceed 0.85% of the average daily net assets of the Class S Shares. This contractual waiver will continue until at least April 30, 2020 and may not be amended or terminated by the Advisor prior to such date without the approval of the Series’ Board of Directors. The Advisor’s agreement to limit the Series’ operating expenses is limited to direct operating expenses, and, therefore, does not apply to the indirect expenses incurred by the Series through its investments in other investment companies. | ||||

Example

The Example below is intended to help you compare the cost of investing in the Series with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Series for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Series’ operating expenses remain the same (taking into account the Advisor’s contractual expense limitation for the first year only). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||

Current | $113 | $361 | $629 | $1,394 | ||||

Pro Forma | $113 | $361 | $629 | $1,394 |

11

Pro-Blend® Conservative Term Series – Class S

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| Current | Pro-Forma (unaudited) | |||

Management Fees | 0.60% | 0.40% | ||

Distribution and Service(12b-1) Fees | None | 0.25% | ||

Other Expenses | 0.27% | 0.20% | ||

Shareholder Services Fees | 0.20% | None | ||

Remainder of Other Expenses | 0.07% | 0.20%1 | ||

Acquired Fund Fees and Expenses (AFFE) | 0.01% | 0.01% | ||

Total Annual Fund Operating Expenses | 0.88% | 0.86% | ||

| 1Includes payments pursuant to theNon-Distribution Services Arrangement of 0.13% of the average daily net assets of the Class S Shares. Payments pursuant to theNon-Distribution Services Arrangement may be up to 0.15% of the average daily net assets of the Class S Shares. | ||||

Example

The Example below is intended to help you compare the cost of investing in the Series with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Series for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Series’ operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||

Current | $90 | $281 | $488 | $1,084 | ||||

Pro Forma | $88 | $274 | $477 | $1,061 |

Pro-Blend® Moderate Term Series – Class S

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| Current | Pro-Forma (unaudited) | |||

Management Fees | 0.75% | 0.60% | ||

Distribution and Service(12b-1) Fees | None | 0.25% | ||

Other Expenses | 0.33% | 0.20% | ||

Shareholder Services Fees | 0.25% | None | ||

Remainder of Other Expenses | 0.08% | 0.20%1 | ||

Total Annual Fund Operating Expenses | 1.08% | 1.05% | ||

| 1Includes payments pursuant to theNon-Distribution Services Arrangement of 0.12% of the average daily net assets of the Class S Shares. Payments pursuant to theNon-Distribution Services Arrangement may be up to 0.15% of the average daily net assets of the Class S Shares. | ||||

12

Example

The Example below is intended to help you compare the cost of investing in the Series with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Series for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Series’ operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||

Current | $110 | $343 | $595 | $1,317 | ||||

Pro Forma | $107 | $334 | $579 | $1,283 |

Pro-Blend® Extended Term Series – Class S

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| Current | Pro-Forma (unaudited) | |||

Management Fees | 0.75% | 0.60% | ||

Distribution and Service(12b-1) Fees | None | 0.25% | ||

Other Expenses | 0.33% | 0.15% | ||

Shareholder Services Fees | 0.25% | None | ||

Remainder of Other Expenses | 0.08% | 0.15%1 | ||

Total Annual Fund Operating Expenses | 1.08% | 1.00% | ||

| 1Includes payments pursuant to theNon-Distribution Services Arrangement of 0.07% of the average daily net assets of the Class S Shares. Payments pursuant to theNon-Distribution Services Arrangement may be up to 0.15% of the average daily net assets of the Class S Shares. | ||||

Example

The Example below is intended to help you compare the cost of investing in the Series with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Series for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Series’ operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||

Current | $110 | $343 | $595 | $1,317 | ||||

Pro Forma | $102 | $318 | $552 | $1,225 |

13

Pro-Blend® Maximum Term Series – Class S

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| Current | Pro-Forma (unaudited) | |||

Management Fees | 0.75% | 0.60% | ||

Distribution and Service(12b-1) Fees | None | 0.25% | ||

Other Expenses | 0.35% | 0.20% | ||

Shareholder Services Fees | 0.25% | None | ||

Remainder of Other Expenses | 0.10% | 0.20%1 | ||

Total Annual Fund Operating Expenses | 1.10% | 1.05% | ||

| 1Includes payments pursuant to theNon-Distribution Services Arrangement of 0.10% of the average daily net assets of the Class S Shares. Payments pursuant to theNon-Distribution Services Arrangement may be up to 0.15% of the average daily net assets of the Class S Shares. | ||||

Example

The Example below is intended to help you compare the cost of investing in the Series with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Series for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Series’ operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||

Current | $112 | $350 | $606 | $1,340 | ||||

Pro Forma | $107 | $334 | $579 | $1,283 |

Real Estate Series – Class S

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

Current (unaudited) | Pro-Forma (unaudited) | |||

Management Fees | 0.75% | 0.60% | ||

Distribution and Service(12b-1) Fees | None | 0.25% | ||

Other Expenses | 0.35% | 0.25% | ||

Shareholder Services Fees | 0.25% | None | ||

Remainder of Other Expenses | 0.10% | 0.25%1 | ||

Acquired Fund Fees and Expenses (AFFE) | 0.01% | 0.01% | ||

Total Annual Fund Operating Expenses | 1.11% | 1.11% | ||

| 1Includes payments pursuant to theNon-Distribution Services Arrangement of 0.15% of the average daily net assets of the Class S Shares. Payments pursuant to theNon-Distribution Services Arrangement may be up to 0.15% of the average daily net assets of the Class S Shares. | ||||

Example

The Example below is intended to help you compare the cost of investing in the Series with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Series for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Series’ operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||

Current | $113 | $353 | $612 | $1,352 | ||||

Pro Forma | $113 | $353 | $612 | $1,352 |

14

Strategic Income Moderate Series – Class S

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

Current (unaudited) | Pro-Forma (unaudited) | |||

Management Fees | None | None | ||

Distribution and Service(12b-1) Fees | None | 0.25% | ||

Other Expenses | 0.68% | 0.45% | ||

Shareholder Services Fees | 0.25% | None | ||

Remainder of Other Expenses | 0.43% | 0.45%1 | ||

Acquired Fund Fees and Expenses (AFFE) | 0.62% | 0.46% | ||

Total Annual Fund Operating Expenses | 1.30% | 1.16% | ||

Less Fee Waivers and/or Expense Reimbursements | (0.38)%2 | (0.25)%3 | ||

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | 0.92% | 0.91% | ||

| 1Includes payments pursuant to theNon-Distribution Services Arrangement of 0.02% of the average daily net assets of the Class S Shares. Payments pursuant to theNon-Distribution Services Arrangement may be up to 0.15% of the average daily net assets of the Class S Shares. | ||||

| 2The Advisor has contractually agreed to limit its fees and reimburse expenses to the extent necessary so that the total direct annual fund operating expenses of Class S Shares, exclusive of Shareholder Services Fees, do not exceed 0.05% of the average daily net assets of the Class S Shares. This contractual waiver will continue until at least April 30, 2019 and may not be amended or terminated by the Advisor prior to such date without the approval of the Series’ Board of Directors. The Advisor’s agreement to limit the Series’ operating expenses is limited to direct operating expenses, and, therefore, does not apply to the indirect expenses incurred by the Series through its investments in other investment companies. | ||||

| 3The Advisor has contractually agreed to limit its fees and reimburse expenses to the extent necessary so that the total direct annual fund operating expenses of Class S Shares, exclusive of Distribution and Service(12b-1) Fees, do not exceed 0.20% of the average daily net assets of the Class S Shares. This contractual waiver will continue until at least April 30, 2020 and may not be amended or terminated by the Advisor prior to such date without the approval of the Series’ Board of Directors. The Advisor’s agreement to limit the Series’ operating expenses is limited to direct operating expenses, and, therefore, does not apply to the indirect expenses incurred by the Series through its investments in other investment companies. | ||||

Example

The Example below is intended to help you compare the cost of investing in the Series with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Series for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Series’ operating expenses remain the same (taking into account the Advisor’s contractual expense limitations for the first year only). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||

Current | $94 | $375 | $676 | $1,534 | ||||

Pro Forma | $93 | $344 | $614 | $1,387 |

15

Unconstrained Bond Series – Class S

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

Current (unaudited) | Pro-Forma (unaudited) | |||

Management Fees | 0.45% | 0.30% | ||

Distribution and Service(12b-1) Fees | None | 0.25% | ||

Other Expenses | 0.30% | 0.20% | ||

Shareholder Services Fees | 0.25% | None | ||

Remainder of Other Expenses | 0.05% | 0.20%1 | ||

Acquired Fund Fees and Expenses (AFFE) | 0.01% | 0.01% | ||

Total Annual Fund Operating Expenses | 0.76% | 0.76% | ||

| 1Includes payments pursuant to theNon-Distribution Services Arrangement of 0.02% of the average daily net assets of the Class S Shares. Payments pursuant to theNon-Distribution Services Arrangement may be up to 0.15% of the average daily net assets of the Class S Shares. | ||||

Example

The Example below is intended to help you compare the cost of investing in the Series with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Series for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Series’ operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||

Current | $78 | $243 | $422 | $942 | ||||

Pro Forma | $78 | $243 | $422 | $942 |

Board Considerations in Approving the12b-1 Plan

At the Board Meeting, the Board considered whether to approve the adoption of the12b-1 Plan for the Class S Shares of the Series. In preparation for the Board Meeting, the Directors requested that the Distributor and Advisor furnish information necessary to evaluate the terms of the12b-1 Plan. The Directors used this information to help them decide whether to approve the12b-1 Plan for the Class S Shares of the Series.

At the Board Meeting, the Board, including the Independent Directors, based on their evaluation of the information provided by the Distributor and the Advisor, unanimously concluded that there is a reasonable likelihood that the12b-1 Plan will benefit the Series and their shareholders, and agreed to approve the adoption of the12b-1 Plan for the Class S Shares of the Series, and recommend the approval of the12b-1 Plan to the Series’ Class S shareholders. In making such determinations, the Board considered a number of factors, including, but not limited to, the following:

The fee payable pursuant to the12b-1 Plan is reasonable in light of the nature and quality of the services expected to be provided pursuant to the12b-1 Plan.

The12b-1 Plan would replace the Shareholder Services Plan and be implemented concurrently with theNon-Distribution Services Arrangement, and the total operating expenses (before and after waivers) of the Class S Shares of the Series will stay the same or decrease as a result of the changes because the Board has approved reductions in the contractual investment management fees of the Series, and the expense limitations of the Class S Shares of the Series, to offset the impact of the changes.

16

In its deliberations, the Board did not identify any absence of information as material to its decision, or any particular factor (or conclusion with respect thereto) or single piece of information that wasall-important, controlling or determinative of its decision, but considered all of the factors together, and each Director may have attributed different weights to the various factors (and conclusions with respect thereto) and information.

17

THE BOARD UNANIMOUSLY RECOMMENDS THAT

SHAREHOLDERS VOTE “FOR” THE ADOPTION OF THE12B-1

PLAN.

ADDITIONAL INFORMATION

Voting Information

Each Class S Share of the Series is entitled to one vote, and a fractional share is entitled to a proportionate share of one vote. If your shares are held of record by a broker-dealer and you wish to vote in person at the Meeting, you should obtain a legal proxy from your broker of record and present it to the Inspector of Elections at the Meeting.All properly executed proxies received in time for the Meeting will be voted as specified in the proxy or, if no specification is made, in favor of the adoption of the12b-1 Plan.

Any shareholder giving a proxy has the power to revoke it by mail (addressed to the Fund, 290 Woodcliff Drive, Fairport New York 14450 Attention: Secretary), by executing a proxy bearing a later date, or by attending and voting at the Meeting.

For additional voting information, please call1-800-581-5238 Monday through Friday 9 a.m. to 10 p.m. Eastern Time.

Quorum

The presence at the Meeting, in person or by proxy, of shareholders holdingone-third of the total number of votes entitled to be cast by Class S shareholders of a Series shall be necessary and sufficient to constitute a quorum for the transaction of business with respect to the Series.

Required Vote

The12b-1 Plan must be approved by the vote of a “majority of the outstanding voting securities” (as defined in the 1940 Act) of the Class S Shares of a Series. Under the 1940 Act, the vote of a “majority of the outstanding voting securities” means the affirmative vote of the lesser of: (a) 67% or more of the voting securities present at the Meeting or represented by proxy if the holders of more than 50% of the outstanding voting securities are present or represented by proxy; or (b) more than 50% of the outstanding voting securities. Class S Shares of each Series will vote separately on the12b-1 Plan. Approval of the12b-1 Plan for the Class S Shares of one Series is not contingent on the approval of the12b-1 Plan for the Class S Shares of any other Series.

Abstentions and BrokerNon-Votes

Abstentions and “brokernon-votes” (i.e., proxies received from brokers indicating that they have not received instructions from the beneficial owner or other person entitled to vote shares) will be counted for purposes of determining whether a quorum is present at the Meeting. Abstentions and “brokernon-votes,” however, will have the effect of a vote against the approval of the12b-1 Plan, because an absolute percentage of affirmative votes is required to approve the12b-1 Plan. The Fund may request that selected brokers or nominees, in their discretion, submit brokernon-votes if doing so is necessary to obtain a quorum.

Adjournment

In the event that a quorum to transact business or the vote required to approve the adoption of the12b-1 Plan for the Class S Shares of any Series is not obtained at the Meeting, the persons named as proxies may propose one or more adjournments of the Meeting in accordance with applicable law to permit further solicitation of proxies. In the absence of a quorum, the persons named as proxies will vote all shares represented by proxy and entitled to vote in favor of such adjournment. If a quorum is present but insufficient votes have been received to approve the12b-1 Plan for any Series, the persons named as proxies will vote in favor of such adjournment with respect to any proxies which they are entitled to vote in favor of the12b-1 Plan and will vote against any such adjournment with respect to any proxies which they are required to vote against the12b-1 Plan, provided that “brokernon-votes” and abstentions will be disregarded for this purpose.

Outstanding Class S Shares of each Series

As of the Record Date, the following numbers of Class S Shares of each Series were outstanding:

Series | Number of Shares Outstanding | |

Core Bond Series | 10,576,038.824 | |

Disciplined Value Series | 4,845,835.022 | |

Equity Income Series | 1,809,542.464 | |

High Yield Bond Series | 8,692,865.423 | |

International Series | 47,998,261.636 | |

Pro-Blend® Conservative Term Series | 45,584,115.031 | |

Pro-Blend® Extended Term Series | 20,847,574.044 | |

Pro-Blend® Maximum Term Series | 13,066,392.383 | |

Pro-Blend® Moderate Term Series | 26,881,101.072 | |

Real Estate Series | 17,499,770.555 | |

Strategic Income Moderate Series | 2,047,847.506 | |

Unconstrained Bond Series | 73,624,327.520 |

18

Voting Authority of the Advisor

Certain separate account clients of Manning & Napier Advisors, LLC (the “Advisor”), the investment advisor to the Fund,Advisor have delegated proxy voting responsibility to the Advisor pursuant to the terms of their investment advisory agreements with the Advisor. Accordingly, the Advisor has the authority to vote on behalf of these separate account clients the shares held by these clients in the various Series of the Fund.Series.